Budgeting Based on Fundraising Performance

![]() The budget in a nonprofit organization is a key but often overlooked management tool. This resource will focus specifically on how budget based on evaluating fundraising performance.

The budget in a nonprofit organization is a key but often overlooked management tool. This resource will focus specifically on how budget based on evaluating fundraising performance.

Many organizations start to create a budget by thinking through all of their expenses and then adding in any projected revenue, such as fees for services or pledged donations or grants. More often than not, expenses are then deducted from the revenue, and the resultant deficit becomes the fundraising goal. While expenses may be easier to predict, there are a variety of ways that organizations can measure their current and planned revenue sources that will make budgeting more accurate.

Managing Expectations

Organizations that want to start or significantly expand a fundraising program need to have realistic expectations. The old adage that it takes money to raise money is true, and even the best fundraisers need some time to establish or rework systems and strategies before generating additional revenue. That said, a good rule of thumb is that a development department should be able to produce a 300% return on investment in twelve months. Essentially, this means that if a development director is hired at $50,000 annually, within twelve months, they should be raising $150,000.

Second, organizations tend to be overly optimistic when projecting new streams of revenue. It is important to remember each revenue source takes a different amount of time to develop. For example, direct mail may result in nearly-immediate returns, but a profitable direct mail program will take up to three years to develop. Foundation grants can be another source of revenue, but these can take up to a year to secure.

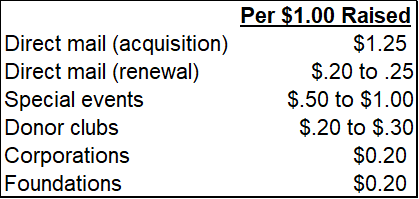

Third, there are different costs involved with raising funds through different vehicles. For example, a special event may cost $80,000 to host but will yield $100,000 in revenue, leaving $20,000 of funds remaining to be invested in the organization. A direct mail piece, however, may cost $.75 each to mail, but if only one out of a hundred results in a donation, the total funds raised may be less than for a special event. The average response rate for direct mail is .88% for acquiring prospect/new donors and 3.61% for renewal/repeat donors.

For this reason, it can be helpful to think of the cost to raise a dollar in addition to being aware of the actual cost of each fundraising activity. Reasonable cost guidelines for solicitation activities are as follows:

Budget Preparation

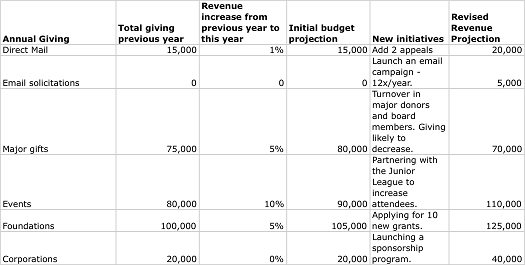

When preparing a budget for the coming year, begin by reviewing the performance of each fundraising initiative in the past year. Most organizations will have revenue lines that include direct mail, e-mail solicitation, major gifts, special events and grants from foundations. Tracking how each revenue line and each appeal performs will help you to adjust your budget, cut back on what is not working well and expand on what does work well.

For each appeal, you should track the total number of donors, the total donations received, the expenses incurred for the appeal, the average gift, net income (revenue less expenses) and the average cost per gift. An example is outlined below:

In this example, you can see that the organization, like many, is able to generate more donations at the end of the year. As the number of donations increases, the average cost per gift decreases.

By measuring the performance of each appeal year after year, you can look for trends, such as seasonality, compelling appeal types and whether average gift size is increasing or decreasing. Since a certain percentage of donors will only give once to an organization, these reports will also help you track whether or not you are able to acquire new donors each year.

Direct, Indirect and Overhead Costs

When determining total expenses, it can be easy to think only of the actual cost of the appeal. For a direct mail appeal, this would include printing, postage and possibly the use of a mail service. For a special event, direct costs would include the rental of the venue, food, entertainment, and any speaker’s fees.

To get a true cost of an appeal, however, it can be helpful to also include indirect and overhead costs. For example, indirect costs will include staff time, gift processing, and the use of computers. Overhead costs include heat, lights, rent and depreciation. Some organizations choose to allocate a portion of the organization’s overhead expenses to the fundraising department, and these costs can then be allocated proportionately to each individual appeal. By looking at the total cost instead of just the direct expense, an organization can get a much better idea of the true expense of an appeal.

Most organizations will find that while special events typically net more than a direct mail appeal, the indirect cost of staff time can make an event a much more costly fundraising appeal than a direct mail piece that can be outsourced to a mail house.

Budgeting for New Revenue

As we mentioned earlier, the development department is often tasked with generating new revenue for expanding programs. When preparing an annual budget, begin by looking at year-on-year trends. If your total revenue increased by an average of 3% for the past three years, it is unrealistic to anticipate a 25% increase in revenue in the coming year. Begin the budget process with a realistic revenue increase by line item.

Second, review new strategies or opportunities line by line. Are there new grants that you are planning on applying for? Did you recently decide to begin an e-mail initiative? Are you going to schedule more direct mail appeals than last year? Based on these new strategies and opportunities, increase or decrease the anticipated revenue for each line item accordingly.

Plan for Growth

Remember that fundraising is a growth program. You should be increasing the number of donors to your organization and total funds raised each year. In order to do this, you need to focus on all of the elements of a good development plan, which include a strong case for support, appropriate staff and financial resources, and leadership from senior management and the board. With these elements, you can build a realistic budget, measure your progress and adjust your efforts as you monitor results.