How to Budget for the Grey Areas: Marketing, New Programming and Facility Expansion

A successful nonprofit will have budgets for operating and capital expenditures, and the budget should work with your organizational goals and mission. This means every dollar spent should have a purpose and a measurable result. Each year, an organization should thoughtfully review its current budget and strategic plans in order to develop a budget for the next calendar year. Review the Giersch Group's resource on the Essential Groundwork to Create and Control Your Annual Budget for more information on budgeting basics.

A successful nonprofit will have budgets for operating and capital expenditures, and the budget should work with your organizational goals and mission. This means every dollar spent should have a purpose and a measurable result. Each year, an organization should thoughtfully review its current budget and strategic plans in order to develop a budget for the next calendar year. Review the Giersch Group's resource on the Essential Groundwork to Create and Control Your Annual Budget for more information on budgeting basics.

When programs and revenue remain the same, budgeting can be a fairly easy process. However, if there are program changes, facility renovations or expansion, or new initiatives focused on marketing, it can be difficult to determine how to budget appropriately for these line items. In this resource, we will highlight the budgeting process and will focus on strategies for closely estimating expenses in what may be seen as “grey” areas of the budgeting process.

Budgeting

A nonprofit’s organizational budget should include an annual operating budget and a capital budget. An operating budget functions like an income statement; it shows the inflows (income or revenue) and outflows (expenses). A capital budget works similar to a balance sheet as it reflects the structure of the organization and its assets. Using a capital budget is many times neglected in smaller organizations. However, large changes, such as a facility expansion or renovation, affect the financial position of a nonprofit. Capital budgeting also forecasts repairs and maintenance of assets, such as buildings, cars and machinery. Because of this, leadership should monitor a capital budget to protect the going concern of a nonprofit.

New programming and facility expansion require additional funding strategies to meet cash demands. An operating budget is the primary way to plan for cash flows. A budget should include all the funding strategies available to the nonprofit, including funds raised through individual donors, foundations, and corporations as well as any potential earned income revenue from membership or ticket sales. As the budget for a new program or facility expansion is developed, it is important to consider the future cash demands of the project after it is finished. For example, renovated buildings may have new or increased operating costs, or programs may have increased expenses due to the hiring of additional staff or expanded activities.

Large program expansions or building projects can require more cash than a nonprofit can raise or generate through traditional revenue streams. In cases like this, a nonprofit may need to launch a capital campaign to raise additional funds. Capital campaigns can be an effective way to raise funds for a specific need or project, but they require a significant amount of planning and strategy. In addition, capital campaigns can take years to plan and implement and can be expensive to launch and maintain.

Approaching a Budget

It is important to remember that a budget is a management tool. As such, the budget becomes a critical part of measuring your organization’s ability to fulfill its mission and purpose.

Define Stakeholders

When creating a budget, consider all the stakeholders and their interest in the budget. This usually means formatting budgets to each group so the information is clearly and easily communicated. For example, if you are applying for a grant for a project, the foundation will likely want to see a detailed project budget in addition to a summary of the organization’s total budget. The board of directors may be particularly interested in reviewing revenue sources or monitoring specific expense line items. As you prepare your budget, think of the different stakeholders that will want to see the budget in the coming year, and ensure that you can break out each specific program or project from the full budget.

It is also important to remember that some stakeholders may not know how to use a budget as a management tool. For example, a teacher in an after-school program may need to be shown how to monitor his expenses against the revenue that has been raised for the program. The board of directors may need to be shown comparable data from the previous year’s budget in order to determine if the revenue and expenses over a given time period are higher or lower than the previous year. Finally, executives should remember to monitor budgets to estimate for cash flows, particularly in seasonal downturns.

Budgeting Income

Implementing new programs and projects are a natural part of organizational growth. However, it can be difficult to anticipate how you are going to fully fund these new opportunities. The first step is to outline realistic sources of funding. This may include foundation grants, donations from individuals or internal fund transfers from savings or underutilized program areas. However, we find that organizations often over-estimate the amount of funds that they anticipate receiving. Because of this, we recommend detailing every way in which you anticipate receiving funds from each source. For example, if you anticipate raising $50,000 from individuals, break this down by the amount you will raise through major donors, the amount anticipated from smaller donations, and the amount raised at a special event. Next, add more detail to each of these areas. If you plan on raising $25,000 from an event, outline the number of people who will be attending, the average donation and the percentage of attendees who will give. Do this same level of planning for each funding source.

It is easy to be optimistic about revenue projects, but in order to successfully launch a new program or project, estimates need to be realistic. By adding specific details to each line item of anticipated revenue, you can compare your projections to the “reality” of past events, past major donor solicitations, and past budgets.

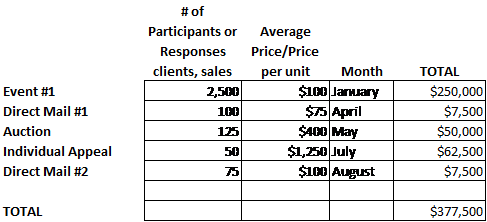

For example, the chart below indicates the detail you may want to include as you plan a campaign to raise $400,000 from individuals:

Funding Restrictions

Increasingly, nonprofits are requesting funds for designated projects or programs. This is a particularly common practice with foundations, which often provide large amounts of capital to nonprofits that align with their funding priorities. However, foundations as well as city, state and federal funders, often have restrictions or guidelines on how their funds may be used. For example, grants can be restricted to program expenses (not administrative expenses) so that every dollar donated has a direct impact. Other grants are limited to capital facility expenses and not on operations or maintenance. Leadership should be cautious when preparing a budget that relies on funds that may come with restrictions. From a budgeting perspective, it is also important to ensure that the organization’s full operating expenses are covered by other income sources.

Budgeting Expenses

A nonprofit’s expenses normally consist of recurring expenses that are either fixed or variable. Fixed costs are items such as salaries, rent and other items that remain the same regardless of the number served in your program. Variable costs are expenses that increase or decrease depending on the amount of programming you offer or the number of participants served. It is important to think through which expenses are fixed and which are variable, as this can allow you to adjust programming size and its resultant expenses and revenue.

For example, an after-school program that is teaching computer skills to teenagers will have fixed and variable costs. The fixed cost is the expense of the teacher and rental of classroom space. In this case the school should try to have a higher attendance in order to “spread” the fixed costs over more students. This will reduce the unit or “per-student” cost and increase the program income. Variable costs depend on the attendance of the after school program. If each student is provided with a $300 laptop computer, the variable cost would be $300 per unit/participant. If the classroom has the capacity for 30 students but funds are tight, the organization may choose to limit the program to 20 students, thereby “saving” $3,000 in variable expenses.

Budgeting for Marketing

There is often confusion in the nonprofit world between fundraising and marketing. The marketing department assists the fundraising department, but they are not the same. The marketing department is in charge of communicating the message and mission of the nonprofit. The fundraising development office uses the marketing departments services to assist in their fund development.

Marketing is arguably one of the most important things your nonprofit can do to ensure future success. Unfortunately, when an organization has tight cash flows, marketing is one of the first things to get cut. Marketing budgets should build off the marketing plan, and each part of the plan should have a specific strategy and stated outcomes. A marketing plan needs to address different target audiences. For example, if a nonprofit wants to expand its base of younger supporters, it needs to outline specific strategies and supporting budget line items for each initiative. In this scenario, the organization could consider hosting a special event with a local celebrity that would appeal to this group, or they may consider advertising through media that is attractive to the types of supporters they want to attract. The budget should include individual numbers for each marketing effort: mailings, social media, events, etc. This detail will provide an outline when comparing budget-to-actual and makes missed revenue and expenses easier to spot.

All marketing results should be tracked to determine success and direct future marketing efforts. A high return on investment will also give marketing employees a chance to validate the marketing expenses when preparing the next year budget. However, not all marketing efforts can be quantified. This can lead to misunderstandings about the value of marketing in nonprofits. When presenting a budget, support your numbers by proving how they align with the strategic plan. Marketing is an investment into your organization; particularly the donor and volunteer base.

Additional Budgeting Considerations

Administrative Capacity

One aspect often overlooked when budgeting is administrative capacity. New programming, facility expansion and marketing efforts all require additional staff to implement and support the project. When a nonprofit receives government funding, it takes administrative staff to direct and lead the program to meet the government requirements. Additional employees might be required if the work load will overwhelm the current administrative staff. If an employee that is already on payroll is going to be leading a project, the budget should include this expense. A budget should include all the expenses needed to implement a project, including indirect or existing administrative costs.

Feasibility

Every nonprofit is passionate about their mission. However, not every project is appropriate for a nonprofit. Timing is one of the biggest issues with potential projects. Make sure your organization is prepared for the demands that new programming or facility expansion require. Leadership should look at the current market to make sure the environment is ready for the project to avoid implementing a new project without sufficient demand. Just because you put in the time and money to create a new program does not mean that there are people able and willing to participate. Take the time to do host a focus group, speak with other organizations doing similar work, or conduct a feasibility study to determine if the project will be successful and supportable in the long-term. Fully understand the risks and potential issues with implementing a project and build it into the budget. No matter what the project, the efforts should support the organization’s mission.

Approval

Finally, a budget must be reviewed and approved by a board of directors. Plan with plenty of time to revise, edit and get approval. Once a budget is approved by the board, leadership should review it periodically throughout the year. Monitor the budget to ensure the actual financials are following the projections. It is not good practice to make changes to the budget once it has approved. However, large changes in programs or organizational structure can require a revision.

One well known exercise to protect against the optimism that goes with budgeting is to take the finished budget and reduce the revenue by 20% and increase the expenses by 10%. Looking at the final result, ask yourself if the organization could handle this result, should it become reality. Having a contingency for missing your budget is an important part of financial planning.

With that said, however, the Board and Executive staff need to firmly commit to the budget. A budget needs to be a commitment that everyone will agree has to be met, whatever the challenge, long hours, creativity or extra effort required. Too often budgets are seen as a wish, a hope, or even a joke. This is a cultural aspect of budgeting that many underestimate. The best way to form a healthy budget culture is to make a budget in the first place, commit to it, and then meet the budget, whatever it takes.

Articles for Further Reading

- Fiscal Management Associates developed a comprehensive budget planning tool that aligns with an organization’s logic model. Designed for larger nonprofits, this tool may be helpful for any nonprofit that is establishing a budget for a new program or project and does not know where to begin: http://www.wallacefoundation.org/knowledge-center/Resources-for-Financial-Management/Pages/Program-Based-Budget-Template.aspx

- For a brief overview of how the budgeting process ties to the organization’s internal accounting procedures and controls, read his article on nonprofit accounting basics: http://www.nonprofitaccountingbasics.org/reporting-operations/budgeting-process

- Clifton Gunderson LLP created a step-by-step outline of how to create a budget. This is helpful for first-time budgeters: http://www.cliftoncpa.com/Content/5HQ5OYA9WU.pdf?...NonprofitBudgeting