Inventory Management

In today’s economy, every company is looking for an edge. Knowing how much inventory to hold and how to track it becomes vital to gaining the edge and managing available cash resources. This resource will address: How and why we track inventory, how to understand lead time & forecasting, and How to cost inventory.

In today’s economy, every company is looking for an edge. Knowing how much inventory to hold and how to track it becomes vital to gaining the edge and managing available cash resources. This resource will address: How and why we track inventory, how to understand lead time & forecasting, and How to cost inventory.

Why We Track Inventory

Inventory systems are relevant to many different types of companies. The key reasons why we track inventory are 1. It is critical to the business operations; 2. It is critical to the balance sheet; and 3. It is critical to the results of operations. Let’s consider each briefly.

- Inventory is critical to operations if running out of inventory means a business loss. Most people think of inventory as goods to be sold, which it is. Therefore running out of inventory means no sales for that period. However, in some businesses supplies are critical to the business. For example, if a restaurant runs out of supplies, such as paper napkins, its business can be affected.

- Inventory is critical to the balance sheet when a financing source is looking to the inventory for collateral. Many working lines are used to finance inventory and accounts receivable. Therefore, accurately showing the inventory on the balance sheet is critical to the business.

- Inventory is critical to the results of operations when the cost of goods sold does not include all amounts that have been purchased for sale. When there are goods held for sale at the end of a period, expensing the entire amount purchased in the period leads to distortions of results. Then in the purchase period, expenses will be too high and in the sale period expenses are too low.

How to Track Inventory

The purpose of inventory tracking is to make business operations efficient and profitable without restricting the company’s cash flow or wasting an employee’s time searching for inventory. Businesses can miss sales opportunities due to stock-outs, tie up cash with excess stock, and lose money on obsolete stock. A good inventory tracking system allows management to at any moment know three key things:

- Quantity of Inventory in stock.

- Inventory ordered and expected arrival time.

- Quantity of Inventory that has been sold or used.

Although a small business many utilize a spreadsheet, there are several typical options for inventory tracking:

- Manual tag system: Every item has a price tag on it and at the point of sale the price tag is removed from the item. Cross-checking the tags against the physical inventory allow the business owner to know how much has been sold.

- Dollar-Control System: This software system helps to track the price an item is sold at and compares the price to the cost of the item, allowing clarification of gross profit margins.

- Unit Control System: This system uses bin tickets and physical inventory inspection, whether daily, monthly or annually, to track inventory.

- Point of Sale System: This records each sale and takes the unit sold out of the inventory, instantly updating the unit count in inventory, so that records are always up to date.

Top 3 Inventory Tracking Software Systems

According to TopTenReviews.com the top three inventory software systems in 2012 are Inflow, Inventoria, and iMagic. The top 10 that were reviewed ranged in pricing from $69.44 to $299.99 for off-the-shelf software. Each software system was ranked based on five categories that include: inventory capabilities, financial capabilities, ease of use, support and other features. Inflow was the software system that offers the most complete product movement history but the only downside is that the system will not run on a Mac computer. Inventoria has much of the same benefits of Inflow but does not support multiple languages or allow for customizable reports or exporting data into Quickbooks. iMagic offers different ways of making and accepting payments but requires an upgrade to have multi-user access. When determining what technology best suits your business, begin by making a list of desired outcomes from the technology. This will help you to shop effectively in the marketplace, while being realistic about the expectations by price. Cloud based softwares, or SaaS, might also be considered to allow ease of expansions at growing businesses or multi-locations.

How to Understanding Lead Time & Forecasting

Lead time is the time period from initiating of an activity to its completion. Lead time means knowing when to order so that the business does not run out of inventory. The purchase lead time, manufacturing lead time, and delivery lead time all factor into this calculation.

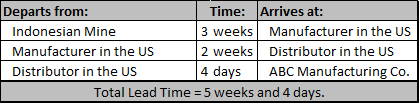

For example, ABC Manufacturing orders its raw material, copper, from a distributor, which gets the material from a manufacturer, which gets the raw minerals from mines in Indonesia.

The lead time calculation alone will not allow management to accurately forecast inventory needs as there are three other things that can affect forecasting:

- Supplier delays delivery.

- Sales are higher than expected.

- Seasonality.

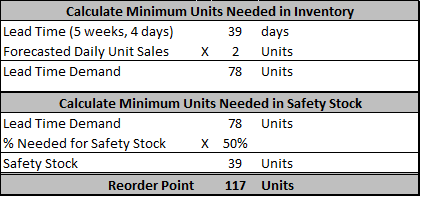

Small Business managers often wish there was a clear understanding of when to reorder inventory to ensure the perfect level of inventory that would avoid stock outs and excess inventory. The reorder point is determined by forecasting daily unit sales multiplied by the days of lead time (called lead time demand) plus the amount needed for safety stock. There are a number of factors that go into determining the amount of safety stock, some suggest using the current lead time demand and then multiplying that number of units by 50%. In the example below, when the amount of inventory is 117 units, an order for 78 units should be placed.

How to Cost Inventory

In determining the cost of the inventory there are a couple of things to consider. The first is the costs that go into the inventory. All costs incurred to purchase, acquire, stock, and make inventory available are part of the inventory costs. For many smaller companies, only directly related costs such as purchase price and freight are in included in the inventory cost.

Accounting has four methods for tracking the costs to the actual inventory on hand: Average Cost method, Specific Identification method, FIFO, and LIFO. The following is a summary of each method and when each might best be used.

Average Cost: This method assumes that the cost of inventory is based on the average cost of the goods available for sale during the period. Inventory is calculated by dividing the total cost of materials of a particular class by the total units available on hand. This gives a weighted-average unit cost that is applied to the units in the ending inventory.

Specific Identification: This method assigns the exact cost of the inventory item. In theory this method is the best method since it relates the ending inventory to goods directly to the specific price they were bought for. However, for businesses that sell high-volume and low-price items this would not be ideal.

FIFO: First In First Out is the system that assumes that inventory is sold in the order that it was acquired or produced, allocating the cost of the oldest inventory to the cost of goods being sold currently.

LIFO: Last-In-First-Out method requires more complex systems for recording and calculating of inventory but has the benefit to businesses with the possibility to reduce taxable income since costs tend to rise over time. However, switching from FIFO to LIFO for tax benefits may have other negative effects on your business due to the “LIFO conformity rule” that requires the business to use the same inventory accounting method for tax and financial statement purposes. The result could be depression of the business’ current earnings and reduction of the value of inventories on the business’ balance sheet, thus giving the appearance of a weaker financial position.

It is useful to note that most companies use either specific cost for larger items, such as vehicles, or a LIFO approximation, where the last prices are used to calculate the cost of inventory sold or used. This is done for simplicity. It is the larger companies with accounting staff that will engage in more detailed accounting method application. Because the tax rules require LIFO be used for financial reporting that goes to banks and investors, this has limited bearing on private companies will no need to give out financial statements.

Action Item: Questions to review your businesses inventory system.

- How many product lines, brand names, or styles of inventory do you have?

- How many SKUs do you have?

- How many items need to be routinely ordered & how often?

- How many new items or one-time purchase items do you have?

- What is the amount of merchandise that needs to be displayed?

- What is the amount of merchandise that needs to be in “Backup Stock”?

Articles for Further Reading

- Entrepreneur.com. “Tracking Inventory The Right Inventory Tracking System makes your life easier and your business more profitable.” April 20, 2006. http://www.entrepreneur.com/article/21852

- essortment.com.“The Basics of Inventory Tracking”. http://www.essortment.com/basics-inventory-tracking-23736.html

- TopTenReviews.com. “Inventory Software Review”. http://inventory-software-review.toptenreviews.com/

- Ian Benoliel. allbusiness.com. “How to Forecast Inventory Needs.” June 18, 2009. http://www.allbusiness.com/company-activities-management/operations-supply-chain/12365224-1.html#axzz1zCmwPcik

- fdcpa.com.“FIFO vs. LIFO Approach A Worthy Comparison”. http://www.fdcpa.com/Tax/0511Tax-news-fifo-vs-lifo.htm