Why does your small business need monthly financial statements?

Small business needs financial statements in order to pay taxes, run the business, and secure investment.

Bookkeeping and financial statement preparation are the foundation for a successful modern business. Small businesses rely on financial reporting in all aspects of running a business. At Giersch Group we offer our expert services to ease your financial reporting.

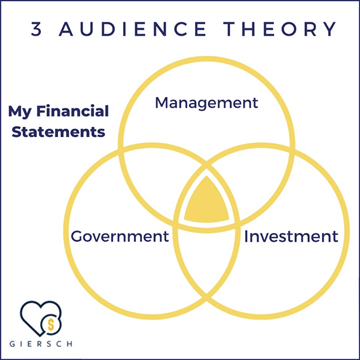

While you may already know that financial reporting is necessary due to the legal requirements, you may not understand its true power potential. Moreover, the dramatic impact implementing a system of monthly financial statements will have on the success of your small business. To illustrate the value of expert financial statements we have developed a method called the Three Audience Theory.

Management

A big reason why understanding the monthly financials is so critical is that it enables you, as the owner, to run your business in an effective and timely manner. As well as enable you to make profitable decisions and adjustments to your business plan when needed. Financial statements allow you to see a snapshot of your businesses financial position and act as decision making tools. Understanding monthly financial statements will give you a clear picture of the financial health of your business. Specifically, the income statement, balance sheet and statement of cash flows. Keeping a detailed record of your businesses monthly financials will allow for analysis to be performed that will uncover trends throughout the year. For example, unstable cash flow throughout the year could imply accounts being settled, but it may also pinpoint a time when less business is coming in. Many business owners are unaware of the trends in cash flow each year because they fail to closely analyze their financial statements. Trends displayed from expert financial analysis will allow you to fully understand your business. Then guide you to make the best strategy decisions to lead your business to cultivate profit and success.

Investment

As the owner of a small business you may find yourself in a position where you are in need of more funding. Maybe your business is going through an expected slow period or you might need to invest in capital or even wish to expand. Whatever your reason is for requiring funding the key component is accurate financial history statements. There are different strategies you can use to generate funding for your small business. You may decide to seek out partnerships, investors, or the most commonly seen take out a loan from the bank. If you decide that taking out a bank loan is the best option for your small business, you will be required to write a loan proposal. Before you begin to write your proposal, you must clearly address the following questions:

- How much money do you need?

- How will your business use the money?

- How will you repay the loan?

- What will you do if your business is unable to repay the loan?

All of these questions can be answered with a tool called a financial model. The financial model is created by strategically analyzing your business’s financial statements. The financial model will help to quantify how much money you need and where to facilitate it. The financial model can also serve to visualize how you will repay your loan. Your proposal must include documents of your business’s complete financial statements (balance sheet, income statement, and reconciliation of net worth) from the past two years and a current financial statement that is not more than 90 days old. It is crucial that all documents in your proposal are carefully reviewed to ensure there is no error. Most banks will automatically deny the proposal if inconsistencies are found as well as the possibility of legal troubles.

Government

The IRS and the State Department of Revenue require that small businesses pay federal and state taxes on income earned and received throughout the year. To determine your estimated tax, you must figure your adjusted gross income, taxable income, taxes, deductions and credits for the year. Outsourcing the creation of your financial statements will save time and help you determine the appropriate tax liabilities.

Small businesses must comply with federal, state and local government requirements. It is easy to assume that the IRS has more important things to do than review your small business operations. However, recent information suggests that the IRS has progressively targeted small businesses for tax audits. There is always a chance that your financials will be reviewed by the government. Producing timely and accurate financials is more important than ever.

Sole proprietorships, S corporations, C corporations, and limited liability companies (LLCs) are distinct legal structures. It is important to be aware that these are all different legal structures that hold different tax requirements.