The Cash Flow Budget Process

A Cash Flow Budget Example for Small Business Owners

The basic principles for budgeting can be found in our resource, The Budget Process. The budget process is typically focused on the income statement and this projects revenues, expenses, and net income. In this resource, the Giersch Group refocuses the process on budgeting cash flow through the use of full financial statements. The cash needs during the upcoming year form an important output of the budget. Cash needs should be modeled on best and worst-case scenarios to allow for mitigation of risks.

Get a cash flow analysis and advice for your business by taking advantage of our free initial consultation in Milwaukee, Madison or Brookfield, Wisconsin.

Budgeting Cash Flows

Most budgets are built at the income statement level. To understand the cash needs for the enterprise throughout the year, it is important to model month by month balance sheets and cash flow statements as well. We refer to this as a full financial budget.

A monthly full financial budget model will show the growth in working capital as the seasonality of the business is modeled. The growth in working capital generally requires cash or other liquidity, such as lines of credit, to fund the inventory and accounts receivable during the busy seasons. Using only an income statement does not allow for this aspect of good budgeting to be seen. A full financial budget will automatically have the cash flow requirements shown on the cash flow statement.

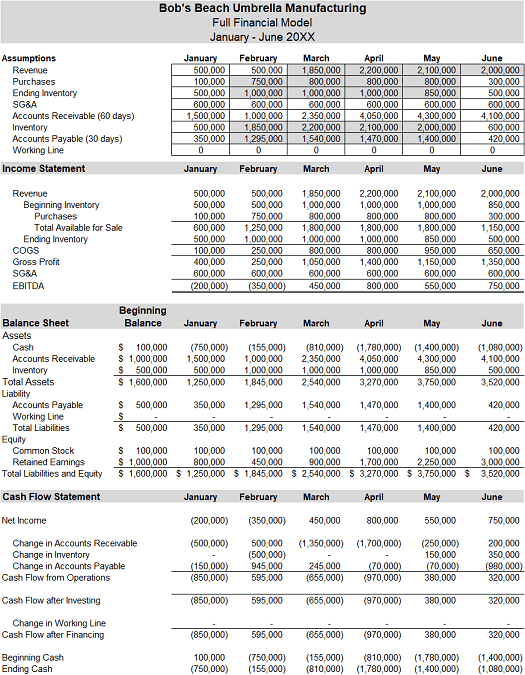

The example of Bob’s Beach Umbrella Manufacturing is modeled below to illustrate a six month full financial budget. This example includes: Income Statement, Balance Sheet, and Cash Flow Statement.

The model starts with an assumption table that highlights the assumptions for the upcoming year. Seasonality for Bob’s Beach Umbrella Manufacturing is relatively pronounced as shown in the assumptions:

- Sales March through June are 4x higher than the other months of the year.

- Inventory must be ordered a month in advance of the month of sales to be on the shelves. Inventory starts as raw materials then moves to finished goods.

- Accounts receivable averages 60 days.

- Accounts payable for suppliers averages 30 days.

- Goal is to have a $200,000 cash reserve during the year.

The results show that working capital plus a reserve of about $200,000 requires $2,000,000 in additional cash based upon the budget for the first six months. The model should be run with a worse-case scenario, which might mean 10 to 20% less revenue than forecast. Given the seasonality and build up of inventory the cash flow situation would require additional working capital, since management likely would not decrease purchases in time given the order cycle. The result would be a buildup of inventory, further tying up cash. This would add about $300,000 to the cash required over six months. Assuming inventory orders are adjusted by April, the year will not have much inventory write-off. Adjustment after April could easily lead to write-offs and further losses. Thus the worse-case cash requirement is $2,300,000.

Options for Meeting Cash Needs

Full budget modeling allows company management to anticipate the months that will have cash flow needs and provide time to find the best option to meet those needs. In the Bob’s Beach Umbrella Manufacturing case, the minimum cash needed for the budget is $2,000,000 and worse-case $2,300,000 over the first six months of the year. There are several alternatives for covering these cash flow needs:

- Management could shorten the Accounts Receivable lag by asking customers to pay earlier.

- Example: Bob’s Beach Umbrella Manufacturing currently has 60 days from sale payments. The company could change its AR policy to 30 days and receive payment for sale a month earlier. Or the company may consider offering larger customers terms such as 2% discount for payments made within 10 days.

- Challenge: While this is a nice idea, many smaller companies are at the mercy of the larger customer. Such customers often do not respond to such requests.

- Management could extend the Accounts Payable lag by asking vendors to allow the organization to pay for inventory or supplies later.

- Example: Bob’s Beach Umbrella Manufacturing currently has 30 day supplier payment requirements. The company could change its AP policy to 90 days to make inventory payments closer to cash receipts. The 90 days arises from 30 days to stock and sell, plus 60 days to collect AR.

- Challenge: Again, many smaller companies are at the mercy of the larger supplier, who may not give 90 day terms. Even smaller suppliers cannot afford the cash flow hit.

- The organization could focus on speeding up the customer invoicing process.

- Example: Bob’s Beach Umbrella Manufacturing currently sells mostly on account, with month end invoicing. They could accelerate invoicing to daily or weekly, which could reduce AR time by up to 30 days.

- Challenge: Again, a small company may not have the systems to allow faster invoicing or customers may not want multiple invoices.

- A line of credit from a bank is a common solution for supplying seasonal cash flow needs.

- Example: Bob’s Beach Umbrella Manufacturing model shows an adequate line of credit which is used during the year and paid down at the end of each year.

- Challenge: Due to credit tightening the last few years, smaller companies have more difficulty obtaining lines of credit. This is especially true if the collateral is inadequate or the credit history is weak.

- A cash reserve can be maintained to cover the months the cash is needed.

- Example: Bob’s Beach Umbrella Manufacturing currently starts the year with $100,000 in cash and ends the six month period with -$1,080,000 in cash. By retaining a larger portion of excess cash in the company the needs for the next six months will be met.

- Challenge: In small companies owners often need to pay out a significant portion of the year’s profits to cover their own needs.

- The shareholders may contribute additional capital to the company to meet the upcoming cash flow needs. High growth companies experience working capital investment requirements, which is one reason that venture companies need subsequent rounds of financing.

- Example: Bob’s Beach Umbrella Manufacturing currently has $100,000 in capital and $1,000,000 in retained earnings. The shareholders could invest an additional $1,900,000 to fund the working capital needs.

- Challenge: The actual return on investment would generally not be as attractive for a shareholder contribution, and therefore the shareholders may not wish to contribute.

The above are the various ways of meeting cash needs. The key is planning ahead. Lehman Brothers went bankrupt and does not exist today not because it did not have equity, but because it did not have cash. Making arrangements early for lines of credit or vendor/customer terms give the company the best chance to manage the cash needs of the business.