Milwaukee's best bookkeeping services for small business

Proper bookkeeping and accounting is vital for small businesses and family-run businesses. Failure to maintain accurate accounting records can have serious financial and legal consequences, inhibit growth and even cause a business to fold.

Our professional bookkeeping service gives you CPA-ready books, regular reporting, and online accounting support at an affordable price. You'll have more time to spend running your business and learn how to make strategic decisions based on financial data.

The Giersch Group has office locations in Milwaukee, Madison, and Brookfield. While we draw many of our clients from southeast Wisconsin, our online bookkeeping services are 100% virtual and available to businesses anywhere in the country.

Book a free, no-obligation consultation with us today to learn how our bookkeeping services can benefit your bottom line. Bring in your balance sheet for a free analysis, or just come with a list of questions.

We'll sit down for 30 minutes, pressure-free, so you can learn about our process and decide if our approach is right for you.

Real Testimonials from Giersch Group Customers

Bookkeeping Services Setup & Training

For convenience and efficiency, we urge all our clients to migrate to QuickBooks™ online or a similar cloud-based solution. The Giersch Group can facilitate this transfer and train the client in the viewing of reports from the online software. We'll help you understand how to use your financial statements to make decisions for the good of your business. QuickBooks™ setup can be done as a standalone service, or we can take over your bookkeeping entirely depending on the level of support you need.

New to online bookkeeping services?

We can help you choose the right version and teach you how to use it.

Not sure if you've been doing it right?

We can clean up your books and review them periodically for accuracy.

It's YOUR money--you tell us how much help you need and we'll simplify your accounting procedures.

We make cloud-based bookkeeping software easy to use so you'll save time.

Bookkeeping reporting packages

We make cloud-based bookkeeping software easy to use so you'll save time.

The primary function of our bookkeeping service is to provide a monthly, quarterly, and annual reporting package in full accrual accounting:

- Beginning balance sheet for the period

- Ending balance sheet for the period

- Income statement for the period v. budget and/or previous period

- YTD income statement v. budget and/or previous period

- Cash flow statement for the period

- Company dashboard of basic financial ratios

We don't just deliver a monthly financial report and leave you to figure it out - we explain how to use your numbers to grow your business and make more money.

We work with small business owners all the time. They can afford our services and so you can you. Call or send us a message online to schedule a free consultation today.

Want to see a sample of our reporting package? We're happy to walk you through one.

The benefits of our unique approach to bookkeeping

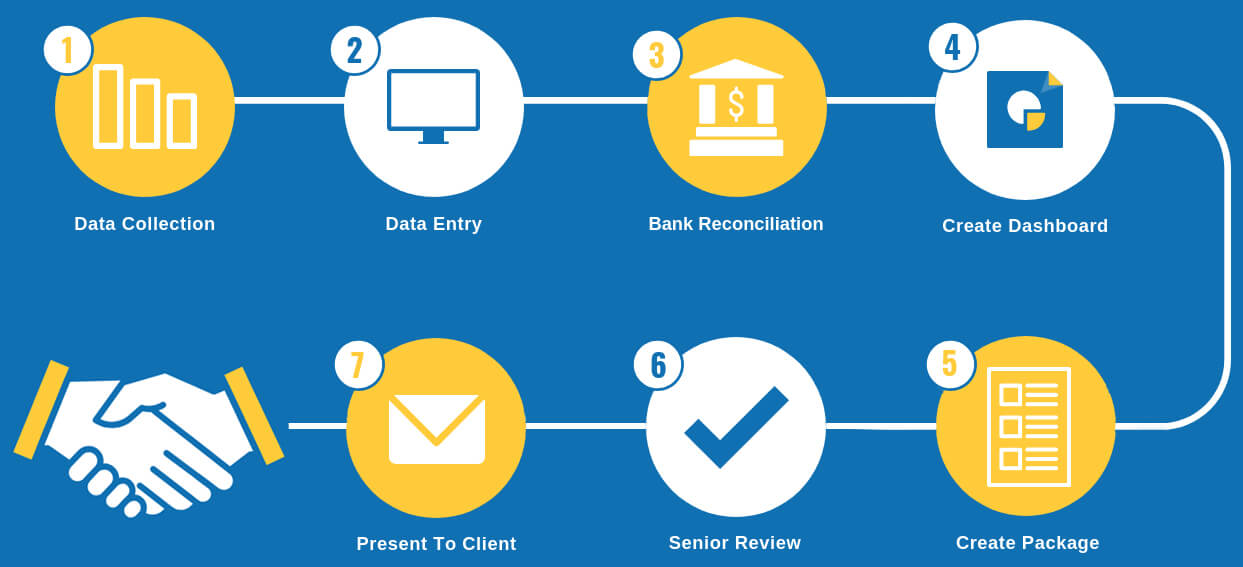

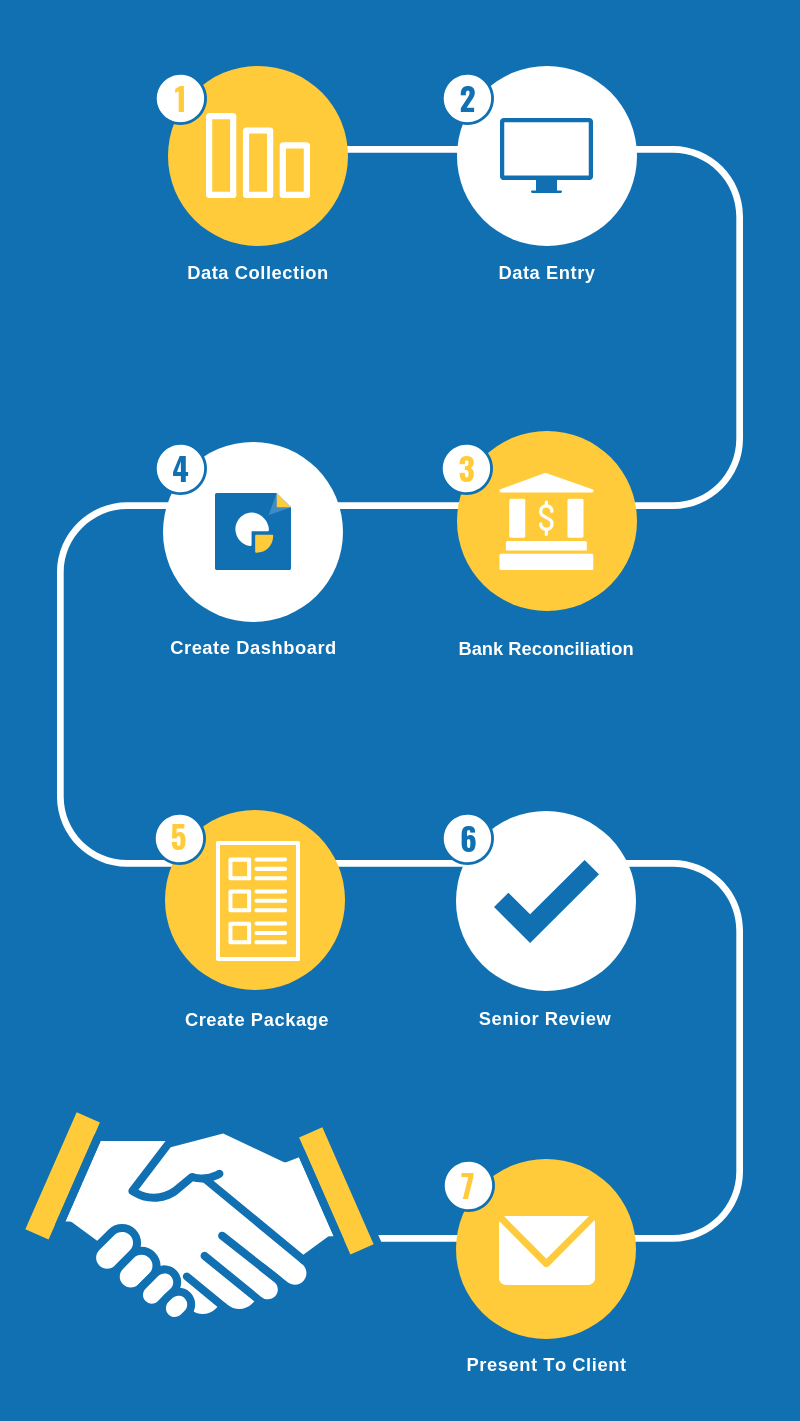

Keeping financial records for a business is a complex process involving many steps. In larger companies, these steps are separated into different roles, and even at times different departments.

The benefit of the Giersch Group is that you get a team approach to your financial system's needs for a very reasonable price. We approach each client with the following team:

Controller: Every client is assigned a controller who acts as your own personal account manager. He or she will work with you to make sure your financials are done correctly and your monthly report focuses on the areas of greatest concern to you. It is the job of the controller to oversee the Giersch Group bookkeepers and consult with a Giersch Group CFO as needed to solve more complex strategic issues.

Bookkeepers: A bookkeeper is responsible for putting all of a business's financial transactions into financial statements. This is done primarily through data entry of all transactions into quick books, categorization of transactions into the chart of accounts, and reconciliations of all transactions with the bank account.

CFO: Giersch Group CFOs have decades of experience in small business financial systems and reporting. They are able to step in as necessary to handle thorny withholding tax issues and complicated payroll and insurance questions, as well as to give strategic business advice as needed.

Most bookkeeping relationships we undertake tend to follow this pattern:

- Assessment & Set-Up

- Triage & Repair

- Standardization

The Assessment & Set-Up phase begins in our first informational meeting and lasts for about the first 30 days of our working relationship as we learn the current state of your financial systems.

The Triage & Repair phase consists of working with you to prioritize the most important issues to address in the short term – typically around 90-120 days.

Once we've gotten into a monthly routine we'll be able to standardize the systems. The cost of our bookkeeping services varies, based on your needs.

Our approach to bookkeeping leverages the power of teamwork for your benefit.

Proven Process

The Giersch Group will provide all necessary bookkeeping services, as directed by you, such as data entry, bank reconciliation, bill pay, and payroll. We will also produce a monthly financial package that includes:

- Income statement

- Balance sheet

- Statement of cash flows

- A simple dashboard

Other financial and bookkeeping services you may request can also be included.

Additional services include:

- Payroll (& Employer Withholding Tax Filing)

- Check Writing (A/P) & Collections Calls (A/R)

- Outsourced accounting & HR services

- Sales and Use Tax Filing

- Cash Flow Analysis & Strategy

- Budgeting

- Financial modeling

- Audit Support

- Company Value Analysis

- Basic HR Management Services

- Creating or Refreshing Employee Handbook

- Creating Org Chart

- Writing Job Descriptions

- Professional Development Plans

- Employee Review Templates

Bookkeeping services for every business

No matter what industry you work in, the Giersch Group provides the best value in bookkeeping:

Bookkeeping for LLCs

A solid bookkeeping system is crucial for a limited liability company. Good bookkeeping habits keep your personal and business assets separate so liability can truly be limited. LLCs must keep income, expense, and credit records for a minimum of three years, and file local/state/federal tax returns. Without an established bookkeeping process, tax time can be painful and more expensive when your CPA has to sort through a pile of invoices and receipts.

Book a free consultation with us to find out:

- Exactly how our bookkeeping process for LLCs works

- Which taxes LLCs pay

- Which QuickBooks is best for your LLC

- How LLCs should track business expenses & income

- How to pay yourself in a single-member LLC

- How our bookkeeping reporting package delivers ROI for limited liability companies

The Giersch Group has experience helping a wide variety of businesses throughout the Milwaukee and Madison metro areas. No matter what type of business or organization you’re running, we will cater our bookkeeping & consulting services to your needs.

Whether you consider your organization to be a small business, medium-sized business or charitable organization our services will help you. Every type of business deserves and benefits from professional bookkeeping support.

Our experience working with clients in many different industries helps us develop custom services for your business and budget. Book your free consultation today to learn how we can help you.

Service area for our bookkeeping services

Our outsourced accounting & virtual CFO services are available anywhere in or outside of Wisconsin.

From our offices in Milwaukee, Madison, and Brookfield we primarily serve businesses located in and around Milwaukee, Dane, Ozaukee, Washington, and Waukesha counties.

Milwaukee County bookkeepers serving: Downtown Milwaukee, Shorewood, Whitefish Bay, Glendale, Fox Point, River Hills, Brown Deer, Granville, Butler, Wauwatosa, West Allis, Greenfield, Hales Corners, Greendale, Franklin, Oak Creek, South Milwaukee, Cudahy, St. Francis & everywhere in between.

Dane County bookkeepers serving: Madison, Middleton, Waunakee, Windsor, Sun Prairie, Cottage Grove, McFarland, Fitchburg, Verona, Riley, Pine Bluff, Cross Plains, Springfield Corners, Black Earth, Mazomanie, Mt. Horeb, Belleville, Rutland, Stoughton, Kengosa, Deerfield, Monona & everywhere in between.

Ozaukee County bookkeepers serving: Mequon, Thiensville, Cedarburg, Lakefield, Grafton, Saukville, Port Washington, Knellsville, Newburg, Waubeka, Fredonia, Holy Cross, Belgium, Dacada & everywhere in between.

Waukesha County bookkeepers serving: Waukesha, Brookfield, New Berlin, Muskego, Big Bend, Vernon, Mukwonago, Jericho, Eagle, North Prairie, Saylesville, Genesee Depot, Ottawa, Wales, Dousman, Delafield, Oconomowoc, Monterey, Nashotah, Hartland, Merton, Town of Lisbon, Sussex, Lannon, Menomonee Falls, Butler, Pewaukee & everywhere in between.

Washington County bookkeepers serving: Germantown, Hubertus, Richfield, Thompson, Ackerville, Hartford, Kirchhayn, Jackson, Cedar Creek, Slinger, Cedar Lake, St. Lawrence, Allenton, Addison, St. Anthony, Kohlsville, Wayne, Kewaskum, Boltonville, Fillmore, Cheeseville, Young America, West Bend, Nabob and everywhere in between.

Bookkeeping service FAQs

Why do I need financials?

Many small business owners find producing financial statements to be a painful exercise. Often they are unsure why it must be done. Most common answers – in the order that we most often hear them are:

1.) To give to my accountant so he can do my taxes.

2.) To give to the bank when I want to open an account or line of credit.

3.) To give to the bank when applying for a mortgage or refinancing.

4.) To know how we’re doing.

It is the final answer that is the most important to the Giersch Group. We operated as strictly management consultants for 13 years prior to taking on our first bookkeeping client. In those years, our constant focus was always to stress to our clients the importance of timely accurate financial information. While most clients knew the importance of their P&L, few spent much time looking at their balance sheet, and even fewer spent any time looking at a cash flow statement.

We also found that most small business owners thought about their money in terms of “cash” rather than “accrual” accounting. This leads to many problems with cash flow, AR and debt. To remedy these problems, we decided to start a bookkeeping firm that would solve the lack of timely accurate financial information in the small enterprise world.

In doing so, we have made those bankers and accountants very happy. Now, when they get the financials from our clients, they know what they are looking at, and they are pleased with the timeliness and accuracy of the information.

Should I hire a bookkeeper or a bookkeeping firm?

There are many benefits to hiring a firm to manage your financial systems.

SECURITY: Small businesses and nonprofits are often the victims of fraud when one person has too much access and freedom with the books. Having adequate separation of duties is difficult at the small enterprise level due to the lack of staff. Hiring a firm to help you with your services solves this problem as the Giersch Group will assign at least two people to your account, along with a senior staff person who will do the monthly and quarterly reviews.

FLEXIBILITY: Whereas a single part-time bookkeeper may need time off or may not be able to provide more hours during busy seasons, the Giersch Group has the flexibility to staff up during the times you need us most.

COST: Hiring a full-time bookkeeper can come with a great deal of overhead, benefits, and employer taxes. The Giersch Group’s fees are often equal to a bookkeeper’s base pay, with no additions for benefits, overhead, or employer taxes.

QUALITY: An individual bookkeeper is only as good as his or her training and experience. The Giersch Group has a team of professionals that will work on your books, and there will always be two senior staff who will review your books monthly, quarterly, and annually. In addition, we will help you learn how to read your own financials and teach you the basics of managing your books at no extra charge. In addition, we can provide many other in-depth services that can help you better manage your enterprise using the data provided by your financials.

The Giersch Group is more than an employee or a bookkeeper, we are a team that is here to partner with you on running your organization based on timely and accurate financial data.

How much should I pay for bookkeeping services?

Basic bookkeeping services for a privately held, owner-operated business under $3M in annual revenue can cost anywhere in the range of $5000 to $40,000 per year depending upon the amount and types of services required. The most important variable is whether you need full-time or part-time bookkeeping and whether or not your bookkeeper is being hired as an office manager and administrator.

Part time bookkeepers range from $25 to $75 per hour, while full time bookkeepers who perform other office duties can range from $30,000 to $50,000 annual salary. Many entrepreneurs will outsource their bookkeeping because of the technical nature of financial accounting. Hiring an individual bookkeeper or using a temporary placement service is common, but turnover can be detrimental to the integrity of financial statements. In addition, low cost, hourly bookkeepers often do not have the technical expertise to handle more sophisticated issues like sales tax filings and certain audit procedures.

Learn more about pricing for Giersch Group bookkeeping services and why our approach to bookkeeping is better for small businesses.

How do I know if my bookkeeper is stealing from me?

When a bookkeeper is stealing from a company, it is often a result of a lack of financial oversight by the owner and poor separation of duties in the financial controls.

When your bookkeeper is stealing from you it is common to find the following conditions present in the company:

- Owner rarely asks for detailed financial statements

- Owner does not review the bank account balances on a regular basis

- Owner is not comfortable with "the numbers" and leaves it all up to the bookkeeper

These conditions constitute a lack of oversight and do not guarantee theft, but addressing these three items alone can usually prevent theft and embezzlement in a small business.

Regarding financial controls, companies that experience theft often have the following symptoms:

- Bookkeeper has control over all financial data input

- Bookkeeper has control over the financial reporting (or there is no reporting)

- Bookkeeper has access to cash

- Bookkeeper has permission to make transactions to your account through online banking or in person

- Bookkeeper is in control of who has access to financial information, including bank statement

These conditions constitute a poor separation of duties. The separation of duties is a common issue in small businesses and is difficult to overcome. However, these conditions do not prove that your bookkeeper is stealing, they just make it very easy for that person to do so.

Signs that you may currently have an embezzlement problem include:

- Difficulty getting reports from the bookkeeper on the financial state of the company, and/or receiving reports that are confusing and unclear

- Resistance by the bookkeeper to allowing any outside access to the books, such as bringing in consultants, switching payroll providers, hiring an audit firm, etc.

- Difficulty in getting a bank statement from the bookkeeper, no longer seeing them come in the mail, etc.

- Complaints from vendors about late payments, incurring of late fees, missed payments, etc.

- Frustration with the bookkeeper by other members of the company, often because of their dictatorial control over all things financial.

This last point, this is something that the owner can often see as a positive, feeling that the bookkeeper is keeping a close watch on the money. This is okay, as long as the owner is also keeping a close watch on the money. The surest way to avoid embezzlement is to ask for a full set of financial statements every month (P&L, Balance Sheet, Cash Flow Statement) along with the bank statements.

It is easy enough for the owner to get daily bank account balances sent to their inbox or to review them online periodically to make sure that they match with the numbers on the Balance Sheet. Finally, a working cash flow forecast that ties to the bank every Monday is an excellent way to manage cash levels and prevent fraud.

Contact Milwaukee's best small business bookkeeping firm for accounting services you can trust.

How do I know if my business is making a profit?

A company makes a profit when its revenues exceed its expenses. Profits are usually measured at certain fiscal periods, such as monthly, quarterly and annual profits. Profits are listed on the bottom of the Profit & Loss Statement (hence the term "bottom line"). Profit should not be confused with money in the bank, even in a purely cash business or a business that makes its money at the point of sale. This is because the receipt of revenue and the payment of expenses are rarely matched chronologically due to the nature of business transactions.

When a company is unclear about the amount of profit it is making this is usually caused by weak financial data and poor accounting practices.

Confusion over the amount of profit a company is making can also be due to the different types of profit that are possible. Gross Profit is known as the amount of money left over after direct costs for the production of good or services (aka, costs of goods sold) have been taken out of the company. Gross Profit is not pure profit because it does not take into account overhead or fixed expenses.

Once fixed or overhead expenses have been taken out, what remains is Net Operating Income. This is the amount of money left over after all costs to operate the business have been taken out. However, some costs, such as refunds, interest, or owner draw may come out below the Net Operating Income line. Once all of these additional costs or revenues (often called "other income/expense") are taken out, the bottom line is Net Income. This is considered by most to be the only measure of pure profit.

The surest way to track if your company is making a profit, and what cost structures are impacting that profit, is to make a business model for your company. A business model is a Profit and Loss Statement representation of your company with % of revenues tracked on major cost centers. The following business model represents the different kinds of profit and how ABZ, Inc. turns a dollar of revenue into a dollar of profit.

Bookkeeping firm with flexible support services

If your money is important to you, then the bookkeeper should be one of the most important roles on your team. Too often bookkeeping is another hat given to an already busy employee. Sometimes that person is the owner-operator who is trying to do it all themselves. A good bookkeeper who can present a timely, accurate financial package every month, with helpful commentary and discussion is an indispensable piece in building a great business that lasts.

The Giersch Group provides as much or as little bookkeeping support as you need for your small business or nonprofit organization. We also offer business management consulting, family business succession planning, and professional fundraising services.

Contact us today for a free, no-obligation consultation to learn how our bookkeeping and reporting services can benefit your bottom line.