What is a business model and what should my business model be?

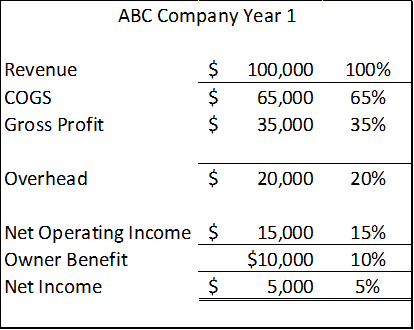

Your business model is way in which your company turns revenue into profit. Your business model is best viewed as an Income Statement in % of revenue format. ABC’s business model below shows how $100 dollar of revenue produces $5 of profit, or 5% Net Income.

The advantage of this type of business model is that it shows you exactly why you are or are not making the desired profit, and how you can make more profit. In this model, $65 of every $100 goes to Costs of Good Sold. If you want to increase your profit, you can work on ways to reduce your direct costs down to 60% of revenue so that extra 5% you saved can drop to your bottom line so that you are now making $10 of profit on every $100.

Digging deeper, your business model should set a target % of revenue for all the major expenses categories that it takes to run the business. The example above only breaks down Costs of Good Sold and overhead. Your business model can further breakdown these categories. Perhaps in Costs of Goods Sold you designate specific %s to materials and labor. And in overhead you break out admin staff from rent and utilities. By doing this, you can find out in which categories you’re overspending is cutting into your profit.

For example, ABC’s model provides for 20% of revenue to pay for overhead. By tracking these percentages every month, the owners of ABC might find that they’re overhead has crept up to 25% because of some new hires. That extra 5% of overhead wipes out the 5% net income they were hoping for, and now they are breaking even or losing money. But if they are diligent about tracking their business model, they may have been aware that the new hires were going to eat into profit, but they were willing to make that investment knowing that long term, the new hires would improve their top line, and soon the overhead % would fall back to 20% and the increased overhead would mean that 5% net income represents a larger dollar figure.

Your business model can also warn you to where you’re underspending. Every machine has it’s optimal rate of performance where the pressure and friction on each part produce maximum production without causing failure or burn out. Your expenses are the same way. There are optimal %s of revenue for each expense category. You might be spending too much or too little on rent or advertising or office supplies. But staff is the best example of this. The optimal % of revenue to spend on staff is like that point in a machine where there is sufficient pressure to cause maximum productivity without causing burnout. A service firm that sets its business model for salaries to 35% has to be aware that when salaries dips down to 28% the staff may be at risk of burning out. On the other hand, if the staff is doing just fine at 28% of revenue, perhaps the 35% target was too high and needs to be reconsidered.