Cash vs. Accrual Accounting - Why Your Checkbook Isn’t Enough

Accounting can be overwhelming for many small business owners. Driving revenues, increasing cash in the bank, and serving clients are typically where the energy is consumed. The result is that little thought is given to the decision of what accounting method is most appropriate for the business.

There are two principle methods of accounting for reporting the financial health of any enterprise: the cash method and the accrual method. When and how expenses and revenues are accounted for is the largest difference between these two methods. But the information shown by the methods is different as well, with the accrual method painting a much clearer picture of the actual results for the period and the financial stability of the enterprise.

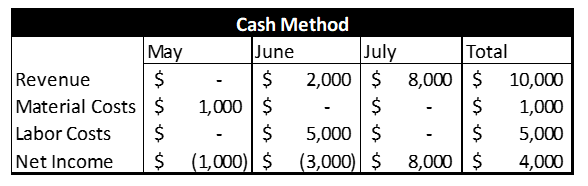

Cash Method

The cash method accounts for expenses and revenue as they are paid or received, very much like balancing a personal checkbook. This simplicity and familiarity is the reason why many small businesses utilize the cash method. Below is a chart of how the cash method would account for the following example.

Peppy Painters were retained on May 25th to paint a house for $10,000. Peppy Painters bought $1,000 in supplies on May 28th. Peppy Painters was paid a retainer for $2,000 on June 10th and completed and invoiced the remainder on June 15th. Peppy was then paid $8,000 on July 1st.

As shown above, the cash method only accounts for a transaction once cash changes hands.

The most noticeable benefit of the cash method is that it continually monitors the company’s current cash position. This knowledge is extremely vital for any business owner. “Cash is King” remains an appropriate motto for all businesses, and the cash method gives a sense we are “watching the cash.”

However, the disadvantages outweigh the advantage. As shown in the example, revenues earned are not necessarily reflected in the same period as the expenses are incurred. As a result, June looks like a poor month when in fact it was a profitable one. A second disadvantage, which the Giersch Group has seen become very troubling, is that expenses are not recorded until paid, thereby not monitoring the accounts payable in a timely fashion. When cash gets tight, bill payment slows. On the cash basis this is not shown in the financials. Instead the bank may have cash, giving the false sense that all is well. A similar disadvantage occurs with receivables. Not tracking accounts receivables can lead to discouragement. Because the company is working hard, but is paid on account, the cash is not flowing in so bills cannot be paid. The company feels like it is making no progress when it could be quite profitable. Timely financing becomes critical in these situations, and the cash flow method will not give this insight.

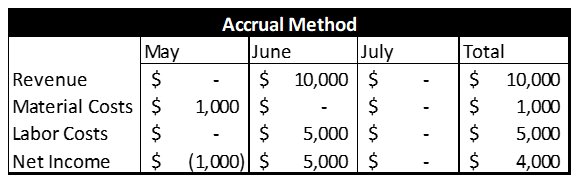

Accrual Method

The accrual method accounts for a transaction when it happens regardless of when cash changes hands. Revenue is recorded according to the billing cycle of the company which is when the invoice is created. The invoice creation could occur when an initial retainer is paid, progress billings are mailed, upon completion of service provided, or when product is ordered. Expenses should be entered by the date on the bill is received. In our example, if Peppy used the accrual method then he would account for the revenue in June when the job was completed rather than May when he was retained or in July when cash changed hands. Below is a chart to show how the accrual method would account for the aforementioned example.

The accrual method provides management with more visibility into the financial health of the business. This means they can track not only how much money should be received through accounts payables and accounts receivables, but also when revenue is truly booked.

Cash vs. Accrual

Although most business owners track outstanding bills and invoices in some way, the accrual method utilizes the payable and receivable accounts to track unpaid and uncollected items within the financials. The use of the accrual method gives a proper report of the income and expense activity for the period and the balance sheet shows the receipts still to be received or bills still to be paid. It is the balance sheet that warns of liquidity problems, where the income statement warns of whether we are profitable. The cash method simply does not give these warnings.

The cash method allows a business owner to easily monitor available cash. It does not, however, provide visibility into how profitable current business activity is. For example, a large influx of cash coming into the business on a certain month makes it seem that, from a financial standpoint, the business is doing very well. However, this could be a group of outstanding invoices being paid at one time while actual business activity is slower.

The accrual method addresses this problem by accounting for revenue when the transaction occurs. It clearly shows what bills and revenues are outstanding, allowing the business owner to anticipate outstanding bills against available cash and outstanding invoices against cash needs. This allows for better cash management, assuming timely payments of invoices and bills.

The Giersch Group recommends using the accrual method because it provides business owners a clearer, forward-looking financial statement to assist in managerial decisions. The utilization of an electronic accounting system like QuickBooks or Peachtree removes the additional accounting work required in the accrual method of accounting. Also, if the accounting is done correctly, a simple preference change in QuickBooks can produce a cash accounting document as desired.

Taxes

Most small businesses use the cash method for taxes, because it allows maximum flexibility for timing revenue and expenses. Revenue can be reduced by slowing collections and expenses increased by paying bills. The IRS has rules for proper use of these techniques and tax avoidance is not proper.

When businesses become large, the IRS rules require that it convert to the accrual method. Corporations that are not S corporations and partnerships that have at least one non S corporation as a shareholder are required by the IRS to report with the accrual method. Also, organizations that have over 5 million in annual revenue are required to make the switch to accrual accounting. The final restriction is that any organization that sells more than 1 million dollars annually in inventory is required to utilize accrual accounting for their inventory[1]. This is done by determining the inventory’s value and deducting the ending balance of the inventory account from cost of goods sold account. Every other aspect of your business can be accounted for utilizing the cash methods.

The Giersch Group does not practice taxation advice and recommends that companies consult with their tax advisor. Taxpayers are not to use tax advice to engage in illegal activity related to tax avoidance.

Articles for Further Reading

- Author Unknown. “Cash Vs. Accrual Accounting.” 24th April, 2000. http://www.inc.com/articles/2000/04/19194.html

- Author Unknown. “Cash vs Accrual Accounting for Small Businesses” http://smallbusiness.findlaw.com/business-operations/accounting/accounting-cash-accrual.html

- Author Unknown “Who Can Use the Cash Method?” http://www.toolkit.com/small_business_guide/sbg.aspx?nid=P06_1344