Gross Margin Concepts for Professional Service Firms

The key component of product mix is the gross margin of the differing products. In this resource, we consider the gross margin concept as applied to the service firm. Unlike companies, which offer products, the service firm has labor for its key cost of sales. (For a full explanation of Cost of Sales, please see our previous article highlighting Gross Margin Analysis)

Cost of sales and the resulting gross margin are directly related to the business model of your company. Richard Block, a partner with Tatum, encourages a re-evaluation of the company’s business model, if gross margins are below 50 percent.1 Every firm needs to establish a clear business model. This business model must include not only strategy and staffing but also the associated anticipated revenue and gross margin objectives.

What is Process Costing versus Job Costing

Gross margin for a service is the sales price, or fees charged, less the cost to deliver. Generally the professional fees to be charged are tied to the costs incurred in the delivery. The challenge is the allocation of costs, such as labor, to the specific service delivered. There are two primary costing structures that companies use for this: process costing and job costing.

Process Costing: Process costing is used when the same type of service activity is delivered on a recurring basis. Examples of these kinds of services are testing labs, dry cleaning, and some elements of tax returns. In process costing, costs are accumulated by team or department. The amount of output is estimated and team costs are allocated based upon output.

Job Costing: This approach produces discrete and different outputs based on the client’s specifications. Costs are accumulated by job, engagement, or contract. Fee estimates or budgets are typically based on standard cost of units of input, such as the number of labor hours required. Costs are then allocated to each job based upon actual units of input. Firms such as doctors, lawyers, accountants, as well as plumbers and builders, tend to use this method.

What makes costing complex is the use of standard costing. Because actual activity will vary from budgeted or planned, there will be a difference between planned gross margin and actual gross margin due to the fact that actual costs are different from the planned. For most modest sized companies, the use of standard costing adds too much complexity making the whole process unwieldy. Therefore, we do not recommend implementing full standard costing. What will be described is a simplified version of costing that minimizes the standard costing problem.

At this point, the key thing to remember is the purpose of this exercise is to determine the gross margin for the services offered. With this information, it is possible to work our service mix to maximize the company’s profitability. A final note here is that the gross margin analysis will give the profitability mix strategy, it does not answer the marketability piece of a service mix.

Example of Gross Margin Determination

Process Costing: Company EFG provides photo development services. It has two people on a full-time basis for this department. It has machines for each person and separate space in its offices for this activity. EFG management spends little time on the department, because its systems are highly automated, including accounting and HR. Marketing is very small because the customers come from the department’s connection with EFG. The chemicals and other supplies for the department have been tracked clearly. All of the costs for the department total $125,000 per year. It is expected to do the same level of business activity as in the prior year, for a total of 30,000 units of activity. Therefore, the cost per unit is $4.167. Current pricing is $6.50 per unit. The gross margin would be $2.333 ($6.50 - $4.167) or 35.89% ($2.33/$6.5). Now we can do several points of evaluation:

- Is this gross margin better or less than other services offered?

- How does our price compare to others in the market?

- Can more business be generated by a lower price?

- On the other hand, will less business be generated at a higher price?

- Note for this company that is a very special analysis because this business depends upon the other activities of EFG. Our experience says a lower price is likely only to lower the gross margin. See the Giersch Group's resources for tools on marketing and market positioning.

- How does this gross margin compare to other activities of EFG?

- Knowing which produces higher gross margin, will directly affect decisions on staffing and investment adjustments can be made based on this added data.

- What should be done if the actual costs change or volume change? This would be the standard costing problem. We would recommend that monthly/quarterly reviews be done on actual costs and volume compared to the planned/budgeted.

Project Costing: Company TUV has an engineering unit with 5 staff people. The total compensation, rent and supply costs for this unit is $350,000. No administrative costs are included. Revenue for last year was $400,000 and the client base activity should be the same for next year. The gross margin for the unit is $50,000 ($400,000 - $350,000) or 12.5%. All TUV projects require proposals that end up being close to fixed fee. The proposals are done using an hours basis with rates set according to staff level. Now we can do some points of evaluation:

- In evaluating this unit against other TUV activities:

- Manage on through-put, which is similar to the unit gross margin noted above. (The Goal is a book that describes this approach.)

- In evaluating different units in a firm, such as TUV, this is particularly helpful. The gross margin for this engineering unit is quite low and probably would not cover TUV overhead or needed profits.

- The gross margin of each member of the unit compared to the overall gross margin. This can be challenging when members work on projects together.

- The unit member charges a certain number of hours which are multiplied times their charge rate to determine the total revenue.

- The total revenue per person will exceed that actually received by the unit. Often this is referred to as realization. Actual revenue less non-personnel expenses can be prorated according to the above total revenue per person, TUV will see the relative revenue.

- The actual costs of a person can be subtracted to give a gross margin per person.

- This allows a measure of analysis for the gross margin profitability for members of this team.

- Several refinements need be considered in this exercise:

- The charge rate can affect the allocation. See below for how to set charge rates.

- The senior people often perform a management role. Therefore, the amount of time charged can be low, but their value is reflected in the professionals managed.

- The effect of downtime is always a problem.

- The effect of missing budget or overworking a project can be a real issue.

- Set charge rates by multiplying the staff’s cost per unit by a ratio that represents the needed recovery per hour/unit.

- TUV has a 12.5% gross margin for the unit, but 25% when only the personnel costs are considered.

- Assume staff person B has a $50,000 in personnel costs and is expected to have 1,500 chargeable units. Thus the cost per unit is $33.33 for B.

- To achieve a unit gross margin of 25% in order to cover other costs and generate targeted unit margins of 12.5% the needed rate is $33.33 X 1.25 = $41.83. In today’s world this is a very low rate.

- Most professional firms such at TUV’s unit will find that professional costs are targeted for 35% of their charge rate. This would make B’s charge rate $100.00.

- TUV’s engineering group probably needs further analysis because the numbers do not tie out. The following are probably the issues:

- The anticipated hours are too high.

- The actual hours are much lower.

- The project-planned hours are much lower, so the actual hours are not being paid for.

- The costs of the staff do not include all of the costs of TUV for the charge rate determination.

- The target gross margin is too low, because the administration and capital costs of the firm are not being properly covered.

- The anticipated hours are too high.

Sample Business Model

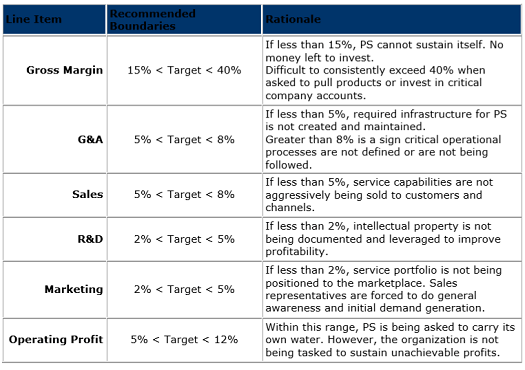

Thomas Lah in his article “The Professional Services Business Model—Fighting the 40/20 Myth” presents the following chart with suggested boundary ranges as a percent of sales.

Articles for Further Reading

- Lah, Thomas E. “The Professional Services Business Model – Fighting the 40/20 Myth.” http://www.quickarrow.com/news_events/serviceline_news/4020Myth.asp 01 Mar 2010.