Preventing Employee Theft

As a small business owner, you know how crucial it is to protect your assets; however, employee theft is a real and serious issue. Though it is a daunting situation, there are steps you can take to prevent it from jeopardizing your small business. In this resource, we discuss the types of theft, the ways you can strengthen your internal controls, and the COSO framework.

Types of Theft

Monetary

This type of employee theft is the most common, and it is present in all industries. Employees may have access to reroute checks to questionable accounts, or it may be as simple as pocketing money from a cash register. This is why segregation of duties is key.

Merchandise

Employees are aware of the security procedures (or lack of) when it comes to retail merchandise, therefore they may develop plans to bypass them.

Supplies (office, from vendors, etc.)

It might seem petty, but the cost of stolen supplies adds up when employees use them for personal use. The successful stealing at small levels emboldens them to try for more in the future.

Time

Employees may record time worked in an inaccurate manner, costing the company more in the form of lost revenue.

Information

Employees who share confidential information and ideas may have a great impact on company security and potential growth.

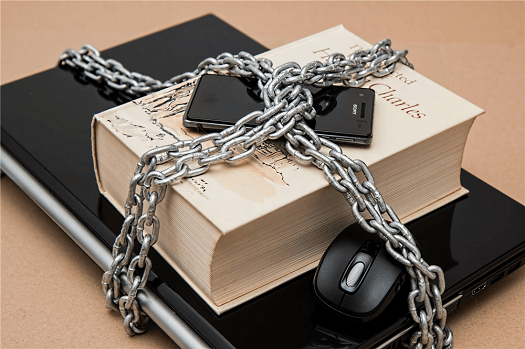

Strengthen Your Internal Controls

You should have strong internal controls. Whether they are for physical items or preventative digital measures,  these mechanisms help to protect your assets. Some general controls include lockboxes and locked doors, but internal controls in an accounting atmosphere include:

these mechanisms help to protect your assets. Some general controls include lockboxes and locked doors, but internal controls in an accounting atmosphere include:

Separation of Duties

The more that specific duties are separated, the smaller chance that any one employee has to commit theft. Because the duties are assigned in smaller increments, discrepancies will be noticed by another team member. For example, employees who handle cash should not be responsible for counting it and/or depositing it.

Accounting System Access Controls

No matter what accounting system you use, it is crucial to maintain secure records of financial data. This can include strong passwords for your accounts and devices, device lockouts, and monitoring access logs of documents and software.

Physical Audits of Assets

These audits include hand-counting business-related items. Cash should be counted on a regular basis for deposit purposes before being kept in a safe. As for inventory, these items can be recorded on a less frequent basis (quarterly or at least annually). These checks help to check for inconsistencies in electronic records.

Standardized Financial Documents

Having a standard format and procedure for invoices, reimbursements, receipts, and other documents can help to spot inaccuracies.

Daily or Weekly Trial Balances

Monitoring your trial balance on a regular basis can help you spot inaccuracies quicker, rather than simply relying on your normal double-entry accounting system (since recording is typically done on a longer term basis).

Periodic Reconciliations

Like the trial balances, periodic reconciliations of bank accounts and credit cards can help to match balances held in each account.

Authority Approval Requirements

By requiring certain members of management to sign checks, issue reimbursements, and other activities, it adds a level of protection to your company assets.

COSO Framework

The COSO Framework is a model for generally accepted practices for internal controls developed by the Committee of Sponsoring Organizations of the Treadway Commission (COSO).The five following components are evident throughout financial operations, reporting, and compliance specifically:

- Control Environment

- Risk Assessment

- Control Activities

- Information and Communication

- Monitoring

Understand the Causes

Even with these precautions, it is still helpful to understand the causes of employee theft. By monitoring your employees carefully and watching for the warning signs, you can get ahead of theft before it occurs. Theft can occur no matter the level of seniority or loyalty to the organization. Having standardized controls and procedures are your best bet to preventing it.

For more information, contact the Giersch Group today.

Resources:

- https://www.score.org/resource/10-ways-prevent-employee-theft-and-fraud

- https://www.thebalancecareers.com/how-to-reduce-employee-theft-4019147

- https://businesspracticalknowledge.wordpress.com/legal-security/employee-theft/

- https://smallbusiness.chron.com/seven-internal-control-procedures-accounting-76070.html

- https://info.knowledgeleader.com/bid/161685/what-are-the-five-components-of-the-coso-framework