Product Mix and Profit and Loss Statement

The Giersch Group has found that many small businesses struggle with the use of financial statements to assist in managing their product mix. In particular, the Profit and Loss Statement is one that has been identified as the one most underutilized. The P&L can and should be used to determine whether or not the company made money, but also helps to understand your product mix. What products or services are loss leaders? Which are most profitable? Which have the highest margins? All of these questions can be answered by the Profit and Loss Statement, as long as it is set up correctly.

The Giersch Group has found that many small businesses struggle with the use of financial statements to assist in managing their product mix. In particular, the Profit and Loss Statement is one that has been identified as the one most underutilized. The P&L can and should be used to determine whether or not the company made money, but also helps to understand your product mix. What products or services are loss leaders? Which are most profitable? Which have the highest margins? All of these questions can be answered by the Profit and Loss Statement, as long as it is set up correctly.

Profit and Loss Statement

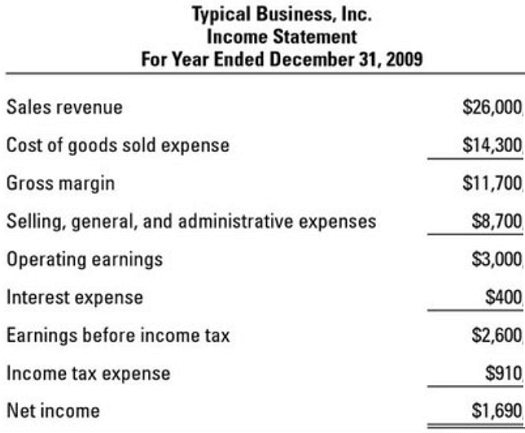

In order to speak about the P&L, we must first define what it is. The P&L statement shows the performance of the company based on the business’s revenues, costs and expenses during a specific period of time. The P&L is synonymous with the term Income Statement. This statement begins with all the revenue from the business and subtracts the expenses and cost of goods sold associated with running the business to show the net income for the company. The revenues are oftentimes referred to as the “Top Line” while the net income is called the “Bottom Line.”

Product Mix

Product mix refers to the total number of products and/or services that a company offers to its customers. The overall categories can sometimes be difficult to narrow down and this problem can be evident within the P&L Statement. An IT company may have a product mix that includes managed services, break/fix, and hardware sales. There may be further differentiation within each of the categories. Hardware could consist of brands like Dell, HP, and Lenovo, however, these would not normally be part of the company’s overall product mix. Product mix is part of the strategic business plan. The plan dictates that a company will seek to earn X, Y, and Z% of revenue from each particular product line. Having a product mix help maintain the business plan. A product mix will also help avoid peaks and valleys (and seasonality) in revenue by offering recurring or monthly fees, as well as projects or one-time sales that help to contribute to revenue. A third objective of product mix is to help define what products/services are most profitable and sell more of those products. Some product line offerings may assist the sales of others. For example, managed services help a company know when to sell break/fix services.

Advantages of a Correctly Set Up P&L

By setting up and categorizing the P&L according to the product mix, a business owner is able to determine which products and services generate the most revenue, produce the highest margins and which services are loss leaders. Breaking down income by product and/or service line will allow a business owner to analyze the product mix and make determinations and corrections to the marketing plan in order to maximize the profitability of the company. It is also important to categorize the expenses in the same way in order to find where to cut costs or what expenses are dragging down the profitability of certain products or services.

The P&L will allow the manager to understand which lines of the product mix need to be focused on and which should not. All companies will have loss leaders, which are products or services which are not profitable, that company has to offer for the sake of offering another product/service at a greater profit, or to attract new customers. However, the P&L is one way of finding out which products/services are most profitable and which are loss leaders. Each line within the product mix can be compared to its correlating expenses in order to determine its overall profitability. This can only be done if the Income Statement is set up correctly.

Reviewing the P&L should help run the business better. By knowing which aspects of the product mix drive profits, the company can focus their efforts on selling those types of products or services. Expounding upon the IT company example from before, by having the product mix correctly represented on the P&L, the owner can quickly see where the revenue is coming from. If the company found that 50% of their revenue was coming from hardware sales, they could address this issue. Hardware sales should be accounting for 20% of the revenue per the strategic plan because they have the lowest margins. The business owner can ascertain this from the P&L and adjust the business strategy to sell more break/fix services and managed services that will increase the overall profits.

Another important point that becomes evident when studying P&Ls is how the revenue is received. Recurring or monthly client revenue that is received on a scheduled basis such as managed services for an IT firm, allows for a company to cover monthly expenses with a baseline of recurring revenue. This is opposed to project revenue that comes in once the work is complete and can be hard to plan around. A P&L that continues to show peaks and valleys each month may identify a need for more recurring fees in order to create a steady flow of cash. By splitting up the types of revenue on the Income Statement, a manager is able to easily see which product lines give him monthly recurring revenue or project-based revenue.

Profit and Loss Statement Issues

Many businesses tend to struggle with the set-up of the P&L Statement when they do begin to generate them. It’s not that it is hard to find templates, but we have found that many business owners tend to lack the organization within the statement to make it as beneficial as possible. While the main point of the P&L is to show the income of the company, it can, and should, be indicative of the company’s product mix. Many businesses do not set up their P&L according to the product mix and end up with either too little or too much description within it.

Not Enough Description

P&L Statements that do not have enough description are unhelpful. The following is an example of a P&L Statement that has too little description:

In this example, it is impossible to tell where the revenue came from. In nearly all cases, revenue will come from sales and it is important to know which product lines are driving that revenue. Including this information will make it more apparent which product lines are contributing more to revenue. We need to know what is included within each parent category in order to address where improvements can be made in both expenses and in revenues.

The P&L should include all product lines and services that the company provides. Sales should be broken down into categories by product mix. Each product and service that a company offers should be accounted for and should have cost of goods sold that coincide with them. Each of these will be a separate revenue account since they are sources of revenue. Think of these as income from primary activities that the business performs in order to make money. Under accrual accounting principles, these revenues should be accounted for when the money is earned, not when it is received. So, if a company provides new home construction, consulting and design, remodeling and handyman services, each of these products and services should be accounted for in revenue. The Cost of Goods Sold section should then be broken down as by each product line in order to keep track of the profitability of each product/service provided.

Secondary activities for income should also be broken down on the Income Statement. Some companies rent out space, so rent income would be a secondary source of income since it is not part of their product mix as a business. Interest on idle cash is another example and is typically stated as interest income.

Too Much Description

Another problem that can occur on the P&L is too much description. Some companies add too many product lines to their revenue section and it creates distraction or “noise.” Finding the right amount of detail is crucial to having a useful Income Statement. The P&L needs to be indicative of the product mix and business strategy.

One way to tell if there is too much description is if there are more products/services listed than the product mix allows. Professional service firms, in particular, commonly make this mistake. New projects can become specific and at times, companies start to list out each new project and service as its own, instead of narrowing down categories based on the product mix and making sure all products and services fall within them. A business owner needs to decide on major products and service lines based on the product mix. Then each new project or service should fall within one of the lines. If they do not, then the overall business strategy needs to be looked at, and the product mix revised in order to accommodate the new product/service and a correlating strategy.

Listing out every different type of project or service type creates distraction and takes away from the effectiveness of the P&L. As new things are listed on the P&L, one should ask themselves “What is my reason for separating this out?” The reason should relate to product mix. If an IT company from the example above makes a 20% margin on all hardware sales, then it is not necessary to break these out as separate product lines. Sales tracking of specific brands can done through other statements. The P&L should provide insight into the profitability of the company and each product or service line within the product mix.

Conclusion

Profit and Loss Statements must be broken down by categories determined by the product mix. Clearly defined revenue sources that make up the product mix make analyzing the Income Statement easier and can allow for more accurate forecasts of future growth. Many small businesses have set up the Income Statement with either too much or too little description in terms in the revenue section. In other words, the company’s product mix is not reflected within the financial statements. The P&L’s revenue section should directly correlate with the product mix in order to be an effective monitoring tool.

Articles for Further Reading

- “How to Set up a Chart of Accounts.” David Barnes. http://www.ehow.com/how_2289534_set-up-chart-accounts.html.

- “Income Statement (Explanation).” Harold Averkamp. http://www.accountingcoach.com/income-statement/explanation/6.

- “Investing Lesson 4: Income Statement Analysis.” Joshua Kennon. http://beginnersinvest.about.com/od/incomestatementanalysis/a/table-of-contents-lesson-4.htm.

- “Beginner’s Guide to Financial Statements.” U.S. Securities and Exchange Commission. http://www.sec.gov/investor/pubs/begfinstmtguide.htm.

- “What is Product Mix?” Rick Suttle, Demand Media. Houston Chronicle. http://smallbusiness.chron.com/product-mix-639.html.

For more information, please visit the Giersch Group at www.gierschgroup.com or contact us at prosper@gierschgroup.com.