Handling Employee Theft and Fraud

I caught my long time employee stealing. How should I handle it?

When you’re in a tough situation such as this, it may be hard to decide the consequences. The issue needs to be addressed. What to do? If you hesitate to fire them, you may realize it was due to your own lack of security, concern, or too much trust. It is crucial that you take the steps to fix the underlying issue, preventing theft from occurring again. In most cases, if you observe the fraud triangle, you should be able to avoid fraud.

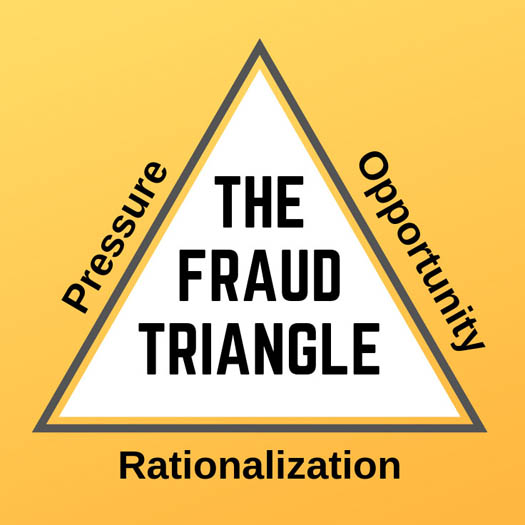

The Fraud Triangle

Involving three components: pressure, opportunity, and rationalization, the fraud triangle considers the main factors resulting in fraudulent activity. First phrased by Donald Cressey, the fraud triangle explains the psychological reasoning of why employees commit workplace crimes.

Pressure

The pressure is the underlying motivation the individual feels to commit the crime. It may include personal financial troubles or even a debt issue in the workplace. The individual may not see any other option to solving the underlying financial issue but sees the workplace as an outlet to solve the problem in another way. These financial issues may be very personal, to the point where the individual may not want to turn to their loved ones for assistance. Examples may include maintaining a specific lifestyle or a growing level of personal debt, but usually, gambling, drugs, or some sort of addiction is involved.

Opportunity

The opportunity for fraud is the outlet that the employee uses to commit the crime. Usually, the opportunities arise from a lack of secure internal controls within the company. Whether it involves the abuse of one’s status in the company, the lack of security controls, or the thought of “I won’t be caught,” the employee considers their plan of action for the theft to take place.

Rationalization

The employees don’t necessarily feel that they are committing theft or other serious crimes; by using rationalization, the employees tell themselves that their actions were permissible. In this way, the employee justifies their crimes by referring to the initial pressure and opportunity to plead their case.

Next Steps

The standard procedure to responding to employee theft is termination; it not only prevents the fraudulent employee from becoming a repeat offender, but it also reinstates the consequences for existing employees. Here are the steps to take:

- Start to document all actions involving the employee after you learn of the theft

- Gather strong evidence

- Prepare an interrogation interview

- Prepare your termination procedure

- This could include a letter and exit interview

- Terminate the employee

- Escort them out of the office

- Monitor the former employee’s actions as they clean out their desk and leave the premises

- Notify your insurance provider and the authorities, if applicable.

- Do not dock pay from their final check - there may be laws in your state prohibiting this

- Complete your employee offboarding procedure

In order to prevent fraud from happening again in the future, it is crucial for you to have strong internal controls and policies set forth to deter fraud. For more information, take a look at our resource on how to prevent employee theft.

Contact the Giersch Group today for a free consultation.

Resources:

- https://www.forbes.com/sites/entrepreneursorganization/2018/10/01/what-do-you-do-when-you-find-out-an-employee-is-stealing-from-you/#66fda9f4960c

- https://www.hrzone.com/hr-glossary/what-is-the-fraud-triangle

- https://strategiccfo.com/the-fraud-triangle/

- https://www.bfscapital.com/blog/how-to-handle-employee-theft-guide-for-business-owners/